Minsheng Bank:Mobile Operating Data Platform Project

China minsheng banking on January 12, 1996, was formally established in Beijing, is China’s first is mainly composed of non-public enterprises in national joint-stock commercial Banks.

Project background

With the advent of the era of mobile Internet big data, the Banks in the competition is fierce, the challenge of external is increasingly serious. Lead in order to keep the minsheng bank mobile products, in a comprehensive and detailed customer data collection, analysis, utilization segmentation on the basis of the customer, improve financial business will fit the needs of customers and products, minsheng bank to start the construction of mobile operation data platform. Through the collection and analysis of mobile terminal operating data, transaction data, user behavior data, etc., as the basis of optimizing product function and improve the user experience, and find more products and service innovation, the promotion of the competitiveness of the mobile financial products.

Requirements of the project

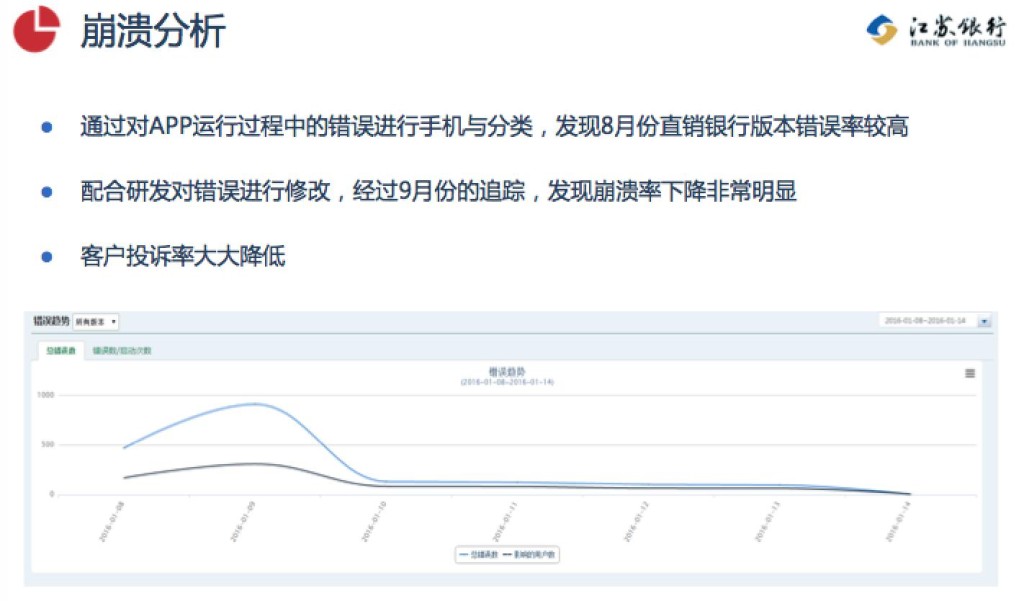

Mobile operating data platform will be used as a mobile application data acquisition platform based on the analysis of the service in the industry all mobile applications, such as mobile phone Banks, direct selling such as Banks, by embedding a simple mobile collection code, without interference with the business logic can be automatic data collection and report the user behavior information; Report the data stored in the mobile operating data platform, calculation and analysis, finally get all kinds of mobile analysis results and in the form of online applications is presented to the development of mobile products and business personnel, for its products and business analysis.

The solution

Hardware: Hadoop cluster 10, application server 3, Web server 3, database server 1.

Software: Razor Cobub big data edition plus two times the development of custom, the basic function of the program for the realization of mobile and mobile application management statistics and mobile application management.

Mobile data platform will be divided into three major modules and functions, performance testing.

Value burst

Big data help optimize the product innovation, and improve the user experience:

Around 2015, Minsheng mobile banking market demand continues to increase the intensity of mobile banking innovation, further optimize upgrade existing services, at the same time introduced fingerprint payment and cloud pay payment functions such as innovation, build more smooth and easy to use experience for our customers. As of November 30, customers over the total number of 18.5 million households, transaction number more than 3 billion deal, transaction amount approaching 6 trillion yuan, these data suggest that, more and more customers has formed use the Minsheng Bank mobile self-service banking business and meet the needs of life habits.

Minsheng Bank direct as the first direct bank, after more than a year of steady operation, the performance way ahead.As of December 2015, the financial assets of nearly 33 billion yuan, the number of customers over 2 million 700 thousand, the balance of financial products, wishful treasure, the total purchase amount of over 780 billion yuan, a total of more than 2 billion 200 million yuan of customer feedback gains.This year innovation introduced built-in pledge loan service of periodic product brand “Dinghuobao”, achieve the high yield and flow of get the best of both worlds, continue to achieve new breakthroughs in the Internet banking service.

中文

中文