5000 Word Essence, Teaching You to Build the Internet Financial Activities Operating Knowledge System

2017 China Internet Finance Annual Report points out that the overall level of Internet financial risk is declining, and the risk cases are initially contained.But the future is still very difficult to purify the Internet financial market, so the government regulation of the following countries will inevitably continue to increase, and the cost will be higher. On the other hand, the development environment of the industry has been gradually cleaned up with the improvement of the fittest of the industry.

We have also seen in 2017, a development of the Internet financial status: insurance development growth is slowing, stabilise financial management module, stock has dropped sharply in the whole accounts, the boom of equity financing, and consumer finance and pay two pieces of business development situation is very optimistic, so how to grab more market?

We see agencies that are doing everything in their power to produce all kinds of play. 2015 thus was born the first Internet financial services section, may say that this is the Internet finance double 11, most of the 11-member cartel, is also the largest, China feedback strength strongest online financial event.

Internet financial products cover many aspects: payment, loan, finance, credit card, insurance, etc. Today I mainly share with you about the operation of Internet wealth management products based on the life cycle, and I hope to give you some ideas of operation.

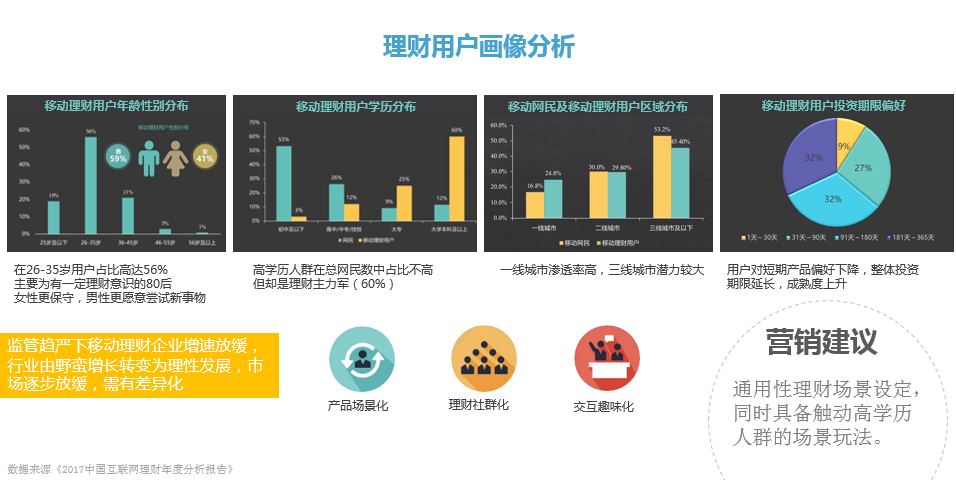

Let’s take a look at financial user portraits:

According to the 2017 China Internet finance annual analysis report, the majority of wealth management users are 26-35 years old, accounting for 56% of the total. More men than women, like loan users, have the highest proportion of educated people; They have a certain financial sense of 80, the first-tier city netizens are not high, but the penetration rate is highest; The number of Internet users in line 3 is high, the permeability is not enough, there is still a large market space.

The growth of mobile wealth management enterprises is slowing down, and the industry is transformed from savage growth to rational development. The market is gradually slowing down. However, users’ preference for short-term products declined and the overall investment duration was extended, indicating that the maturity of wealth management users gradually increased.

The key of operation is to make the scene differentiation, the financial community and the interactive interest. For example, we can set up some scenes that can touch the high educational background to attract the users, such as the overseas credit card case of the previous time in the friend circle refresh. Let’s take a look at the product form of wealth management products.

I. financial product form analysis

According to the financial product cycle division

According to the financial product cycle, it is divided into: short-term + long-term, current and regular.

due on demand

The current product is less, relative to the interest will be much lower, such users may money flexible excessively high enough, or is the financial management is not particularly understand, through a combination of financial knowledge such as the user can cultivate high paying customers or direction for a long period of time, usually is to provide learning content, complete the study can obtain higher interest rates to reward.

Week inreasement:

Regular withdrawal per week, at the same time enjoy a return, if not removed, the longer the higher interest rates, such products cater to the higher requirements for capital flexibility of user groups, these groups usually for low-income people, usually set the bar too low, as low as 100 yuan, this kind of products covers a wider user groups, more flexible, the threshold is lower.

Month increasement:

Monthly withdrawal on a regular basis, at the same time enjoy a week week rose products higher yields, such products are suitable for commuters money, combined with the credit card 50 days grace period for marketing encourages users to made after financial profit at the same time, but frequent operation very troublesome, if can also automatically combined with the credit, reduce the user operation, improve the user experience, there will be a lot of users will choose near moonlight clan.

Quarter increasement:

Medium and short – term products, in the middle of flexibility, as well as the duration of the quarter, the rate of rate increase will also increase.

Deposit for one month:

A person who usually applies to a short-term fund surplus. Usually the money is already used or the money is to be withdrawn after a month or so, in a short-term attempt by some new users to consider the safety of the platform.

Deposit for 2 months:

Short-term wealth management products

Deposit for 3 months:

Short – term financial products

Deposit for 6 months:

Medium-term wealth management products

Deposit for 12 months:

Long-term wealth management products

Deposit for 24 months:

Ultra-long term wealth management products usually have fewer users

The product form of wealth management

Novices wealth management products:

Usually in order to attract new users, many platforms are taking new users into high interest rate policy to attract users, have sent gold, also have sent short-term high interest rates, usually during the activity will have the other new activities to cooperate.

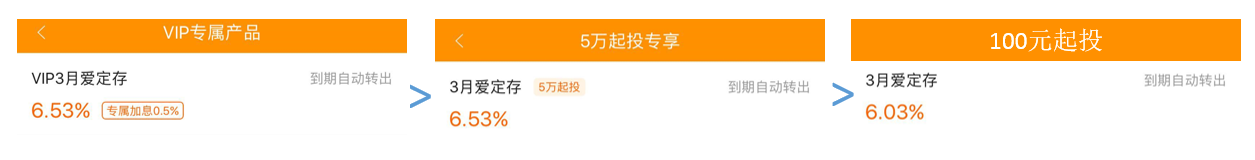

VIP products:

Provide VIP product customization to high paying customers and enjoy higher financial privileges than regular users.

High cast surely:

Setting up a higher level of investment to encourage users to increase their investment compared with a higher yield over the same period.

The principle of setting interest rates basically:

VIP exclusive > high investment > normal casting

A colleague’s financial zone:

Usually such cooperation, financial institutions and enterprises to give employees the yield of higher than ordinary employees, companies are usually cooperation larger enterprises (tencent, jingdong, alibaba, baidu, etc.), and complete certification need employees through E-mail.

Pay money:

Bind bank card, monthly pay day, automatic transfer money, convenient and quick.

Change money:

It is based on the WeChat scenario, with the change of money management, which captures the money of WeChat user’s change.

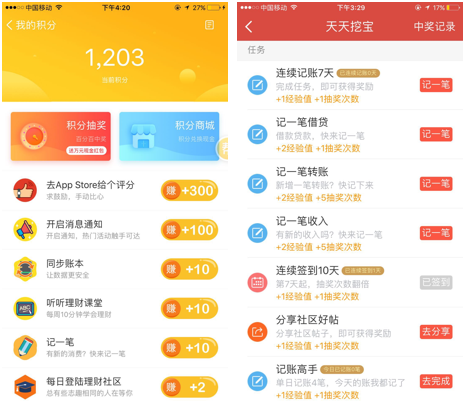

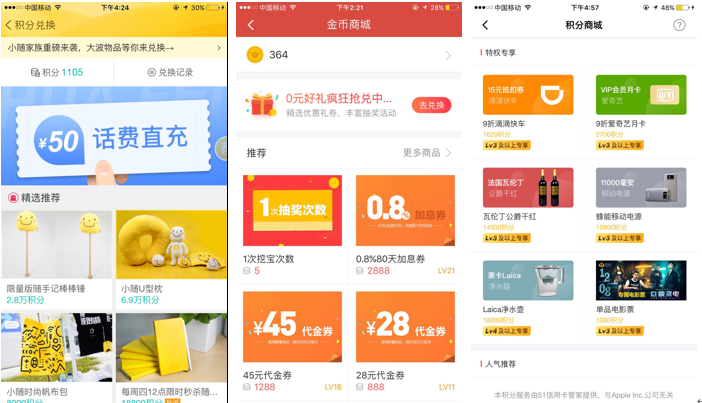

member points:

Set up financial user integral system, integral consumption system, such as: exchange activity participation qualifications, exchange rate coupon, exchange financial gold, VIP, cash prizes, membership system is the key to build integral mechanism and mechanism of consumption form a closed loop.

Ii. Analysis based on the operation of life cycle

Knowing the industry background and understanding the product form, we will then analyze the operation of each stage from the product life cycle meaning.

1. Acquisition

1)Invite prize:

In order to better improve the platform users, usually set to invite contests, for financial products, users tried a platform, there gradually developed a sense of trust, and invite friends incentives to stimulate the old users, the effect will be better than pure do promotion.

By inviting, both sides can obtain a certain reward, including cash reward, the rates voucher, finance, platform credits, physical prizes, etc., usually on the invitation, the number of pyramid incentive policy to encourage users to invite more users.

We need to inform the rules of the activity and the way of accepting the award, otherwise it will add to the burden of customer service. On the other hand, we can divide the reward level of the recommender by the amount of the position, form a second dimension incentive policy, pull up new colleagues, and improve the number of positions of old users.

In addition, the inviter page and to be inviter’s page is not the same, emphasis on the two sides can be rewarded, inviter page can be obtained by inviter stressed after registration on their own rewards, to encourage users to invite, usually on the invitation page because do a contacts list and invited friends benefits ranking, stimulate users.

2)Registered grand prize:

This kind of activity mainly is direct contact with the C end users, generally through other channels to promote touch; The user finds the activity page independently and actively joins in.

The usual channels include information flow advertisement, soft language promotion, platform cooperation, technology website, offline advertisement, etc. The external material will be attractive enough, such as sending New Year’s red envelopes with WeChat, downloading registration, or adding a financial entrance to other platforms.

Every platform, hoping to provide more diversified services, such as medical users only when they are ill will use 160 platform, so in order to improve the user active, increase financial management module allows users to avoid losing customers because of the retained of funds; But if they develop a wealth management module themselves, they will raise the cost, so the best way is to find professional financial companies to work together and charge through CPC, CPM and CPA.

2. Active

1)Free+Integral draw:

In order to enhance the platform’s activity, some games are usually designed, and the lottery is a method used in many industries, which can be used for free trial and integration exchange.

But in setting the odds, must consider the odds problem: if smoke frequently miss will hit the user enthusiasm, if the smoke will increase in the operating costs, so you need to focus on setting up probability model.

2)gameplay:

In order to boost the platform’s activity, many industries will adopt a check-in mechanism, which is usually played with small games, signed and delivered points, or a coupon for interest rate hikes, money management, etc. But in order to improve the user’s activity in a row, we need to set some milestones in the game task incentives, such as continuous check-in week award, doubled, or have the opportunity to enjoy a special gift, stunt to attract enough user participation.

In this kind of play, it is necessary to build fine data model.

First categorizing people can, user activity, the loss from the dimension of position analysis, completes the dimension after analysis in the content of the need for each type of people do fine operation and data model is recommended. For example, in setting up interest rate coupons, we can increase the number of customers by raising interest rates for non-holders.

In addition to the salary and wealth management users, the appropriate content guidance can be used to improve the position conversion of such users.

Such activity pages can be chosen for their own development, or they can choose to intervene in other people’s activities. But get involved in other people’s activity compatibility poor, suggest oneself development.

Generally, the investment of game development is large and the user participation is higher, which can improve the platform activity very well. However, transaction conversion rate is not high, so it is necessary to evaluate the target of operation.

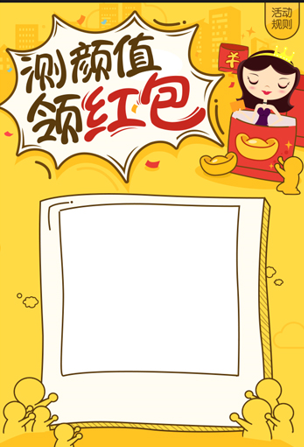

3)Other creative methods:

In combination with the active and popular activities, the product packaging can attract users to participate and learn about the benefits.

If the appearance level of hongbao, by combining the image processing technology, the appearance of the picture is graded and the corresponding reward is given. Or by combining the public welfare for packaging to attract more social concerns, such as the public welfare drawing of tencent’s public welfare, often such a play is so interesting that audiences are willing to participate and retweet.

4)Integral mechanism:

Establish the gold coin integral mechanism, can combine the product function, the task and the game reward obtain integral.

5)Integral convertibility mechanism:

By playing games or conversing for goods, it is best to divide the prizes according to the user’s grade.

6)Membership strategy:

The mature user operation strategy is usually based on the building of a healthy user membership system, so that users can enjoy different rights and interests under this system, thus stimulating the user to develop in a high quality direction.

Usually in member division mainly from the open amount is the number of hierarchies, hierarchical privileges, you need to the company’s business category + user personalization benefits combining (such as the member privileges, birthday gift bag, upgrade gift bag, Thanksgiving gift bag, private service), in line with the pyramid principle, the higher the rank, the greater the rights and interests.

7)Intelligent AI technology play:

Combined with AI big data play, insight into user portraits, intelligent recommendation of wealth management products.

8)Prize for finding bugs:

To better optimize products, users can be encouraged to optimize products through policies such as red packets or membership grade.

Such activities focus on the initial product teams with large user groups and financial input, in order to quickly optimize the user experience and initiate a nationwide search for bug activities.

9)UGC community content production:

In order to encourage the UGC essence content production, set the author hierarchy: senior elementary, intermediate, set up corresponding essence article level of reward system, completes the KOL operation and maintenance, to ensure that the content of output at the same time improving the quality of the article.

10)APP store Version update and comment:

It encourages users to download the latest version of the software and submit it to good reviews for better application rankings.

3. Retention

When it comes to retention, maybe we don’t see a lot of activities that are specifically focused on retention, but the fact that it’s preserved is throughout the operation.

The core of wealth management products is security, high yield, liquidity and satisfaction.

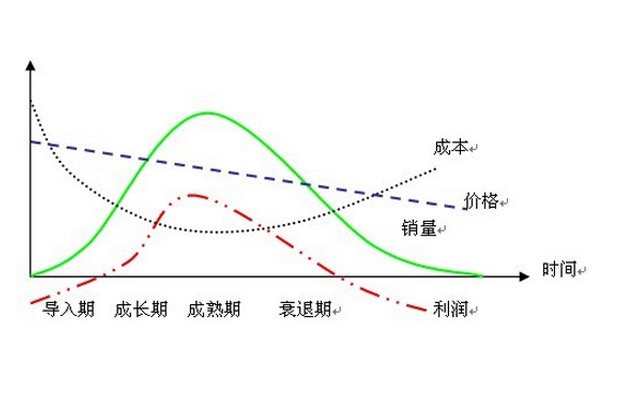

A previous article also said that the life cycle of a product is usually divided into one

Introduction, growth, maturity, decline

four stages.To improve the retention rate of the product, you need to analyze which life cycle the product is in.

What we usually see is the data representation of a certain time node of the platform, but we need to split the user data, usually the result

Data = total number of users + current number of new users – loss of users

.So to improve the retention rate of the user, we need to focus on pulling new and preventing user churn and doing the backflow.

Acquisition aspect:

We need to focus on the quality of users, try to find accurate users, avoid introducing too many non-audience groups, leading to excessive turnover.

Prevent user loss:

We need to do a good job of analyzing the user’s loss, paying attention to the data performance of the next day of user retention, 7 days of retention, and 15 days of retention, and find out how the retention rate of new user is plummeting and analyze it thoroughly. We can from the time dimension, the user operation path dimension to the analysis, a functional analysis is because the product lead to loss of users, such as in the setting of game levels, if the user in a to gate pass special low, will hit the users, leading to loss of users, we need to do is to find these factors and optimize the product.

On the reflux:

Usually we need to analyze: what users are missing? Why is it lost? What are the means of reflux? How to keep users? And how to predict the user’s rapid loss prevention. After finding the lost user, the user can be divided to find the value points that attract each class of users, and to reach this wave of users through effective channels to guide the backflow.

In general, be good at user insight and analysis.

As operation we need to do intelligent dynamic operation, reduce operation of tedious work at the same time, more intelligent words must give users of each life cycle, each picture provide exclusive service users, the premise is to know what circumstances the consumption of user scenarios, and can perceive the change of the user in real time.

4.revenue

1)Limited interest rate hikes:

By introducing a limited number of hot style products on a daily basis, it has triggered a rush of users and boosted revenues and a platform.

2)Long – term products with sales:

Through the short and long tie-in sale, by increasing the yield of short-term financial products, the highest yield of 36%, and as a stunt to attract more users investment, usually early can get good effect; But any activity will be long and the user will be boring.

At the same time, the disadvantage of this kind of activity is that the company’s investment is larger and the cost of investment is strictly controlled.

3)Value management gold/interest rate coupon + bonus:

During the activity period, the user can obtain the corresponding treasure box for the specified product with a single investment, and the additional cash bonus can be obtained.

The following activities can be used to divide up 200 million yuan of financial funds, which can be obtained by cash incentives to stimulate users to invest more.

4)红包雨:

Play combined with New Year red envelopes rain, will be the company’s products packaged into activity prizes (rate increase ticket + financial gold + double card, etc.), cash for big red packets to brush red rain stunt to attract user participation, promotion activity, promote transformation.

5. viral marketing

1)Gimmick enough, new and strange:

By planning some new and strange events, the public attention and dissemination.

For example, a hundred million money contest, in the form of live broadcast, caused a crowd of onlookers to watch, from the early planning, to the on-site police protection; To the American women’s network red live, the user money contest, made the public attention.

Third, summary

This article combines the Internet financial industry trends and game analysis based on the life cycle of financial management products, combed the conventional some operating instructions of the systemic, designed to allow you to run it from the Angle to look at activities.

Basic operation to advanced operation is a process from point to surface growth, advanced operation to senior operation is a process from surface to probing, when we gradually cultivate their holistic view, any run into the problem, we can be found in the global knowledge network is most suitable for him to break point.

A few key points are summarized:

• Understand industry trends:

Cultivate forward-looking, early detection of new opportunities;

• Familiar with strategic objectives:

Understanding the positioning of the brand, combining with its own advantages and capabilities, find the business direction that will improve the performance as soon as possible.

• Be familiar with product business model:

Clarify the possible realizable mode and maximize the performance;

• Global planning capability:

From the global, the best breakthrough method for each point is found respectively.

One last word from a famous economist:

Any social problem arises from economic inequality.

For Internet financial platform, solve social demand to the development of better, pratt &whitney finance is within the scope of the affordable cost, demand for financial services of all social strata and groups to provide appropriate and effective financial services, small businesses, farmers, urban low-income people and other vulnerable groups is its focus on the service object; The future of the Internet financial entering pratt &whitney financial period of rapid development, by combining large data insight, provide dynamic operating strategy, more accurate service for small and medium-sized trace, better realize the integration of online, build a more harmonious society.

中文

中文